Optimism abounded when Birmingham won its bid to host the 2022 World Games. The games were supposed to attract scores of foreign visitors to the Birmingham-Jefferson County area and introduce them to Alabama, bringing substantial and long-lasting eco ...

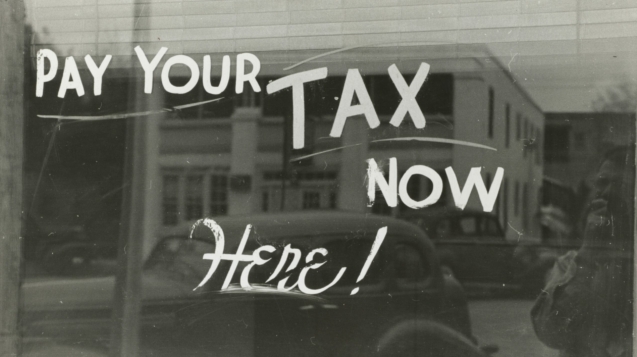

Too many lawmakers would rather spend money on government than return it to the people

On last week’s episode of Alabama Public Television’s Capitol Journal, Gov. Kay Ivey (R) and Alabama Senate President Pro Tem Greg Reed (R-Jasper) spoke about enacting a tax relief package in the 2023 legislative session. Both lawmakers endorsed a on ...

Medicaid expansion debate goes beyond bringing in federal dollars

The Retirement Systems of Alabama (RSA) is joining the push for Medicaid expansion in our state. RSA’s monthly member publication, The Advisor, recently argued in favor of expansion, posing the question, “Do we care about all Alabamians?”The answer i ...

How will Alabama lawmakers spend the remaining $1 billion in ARPA funds?

The American Rescue Plan Act (ARPA) was signed into law nearly two years ago. Alabama’s state government directly received $2.1 billion in federal COVID-19 relief funding under the act, the first half allocated during a January 2022 special legislati ...

Tax cuts would benefit Alabama more than a one-time rebate

Tax cuts would benefit the state more than one-time rebate checks, Mississippi Center for Public Policy President and CEO Douglas Carswell recently explained. This call for permanent tax cuts rather than rebates comes despite the Mississippi legislat ...

How Washington’s looming debt limit fight could impact you

The federal government expects to reach the statutory debt limit this Thursday, setting up another high-profile political showdown in Washington, the first real test for the newly elected Republican House majority.The debt limit represents the total ...

Alabama lawmakers should ‘do more’ with historic surplus

“We can do more.”That was the message Alabama’s newly elected Speaker of the House, Rep. Nathaniel Ledbetter (R-Rainsville) gave lawmakers on Tuesday afternoon. The statement came on the heels of Ledbetter lauding increased state funding for educatio ...

Why Alabamians should pay attention to this week’s organizational session

State lawmakers will convene in Montgomery this week for the official start of the new legislative quadrennium — the 2023 organizational session. While the organizational session is typically a ho-hum affair, decisions about House and Senate leadersh ...

Should Alabama taxpayers bail out Birmingham-Southern College?

Birmingham-Southern College (BSC) says that it needs a $37.5 million infusion of cash to continue operations. Now it is asking state and local officials, as well as alumni, to lobby Gov. Kay Ivey (R) to include that bailout in her upcoming budget pro ...

Five resolutions for Alabama’s government in 2023

The new year is a time for all Alabamians to reflect on the past and make new resolutions for change. It's also a time for the state's government to reflect on their own recent track record.In the past four years, the Alabama government took and spen ...