State General Fund Budget

Alabama’s State General Fund (GF) budget provides funding for all state activities that are not related to education. The largest components of the SGF and the state Medicaid and Corrections programs.

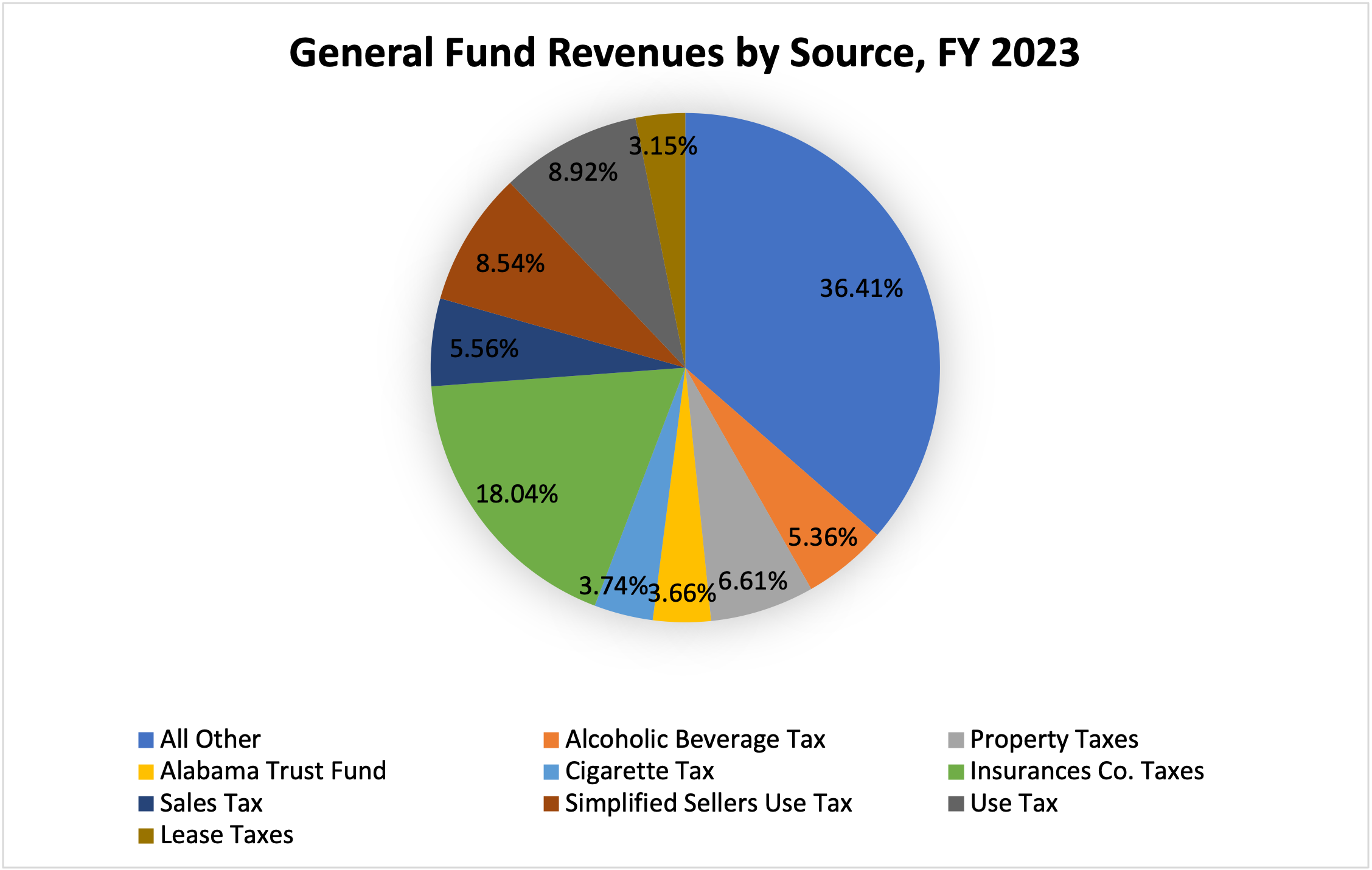

The GF is financed by a wider range of tax levies than the ETF. The major GF revenue sources are ad valorem taxes, insurance premium taxes, a smaller share of the state’s general sales and use taxes, cigarette taxes, business privilege taxes, and rental and leasing taxes.

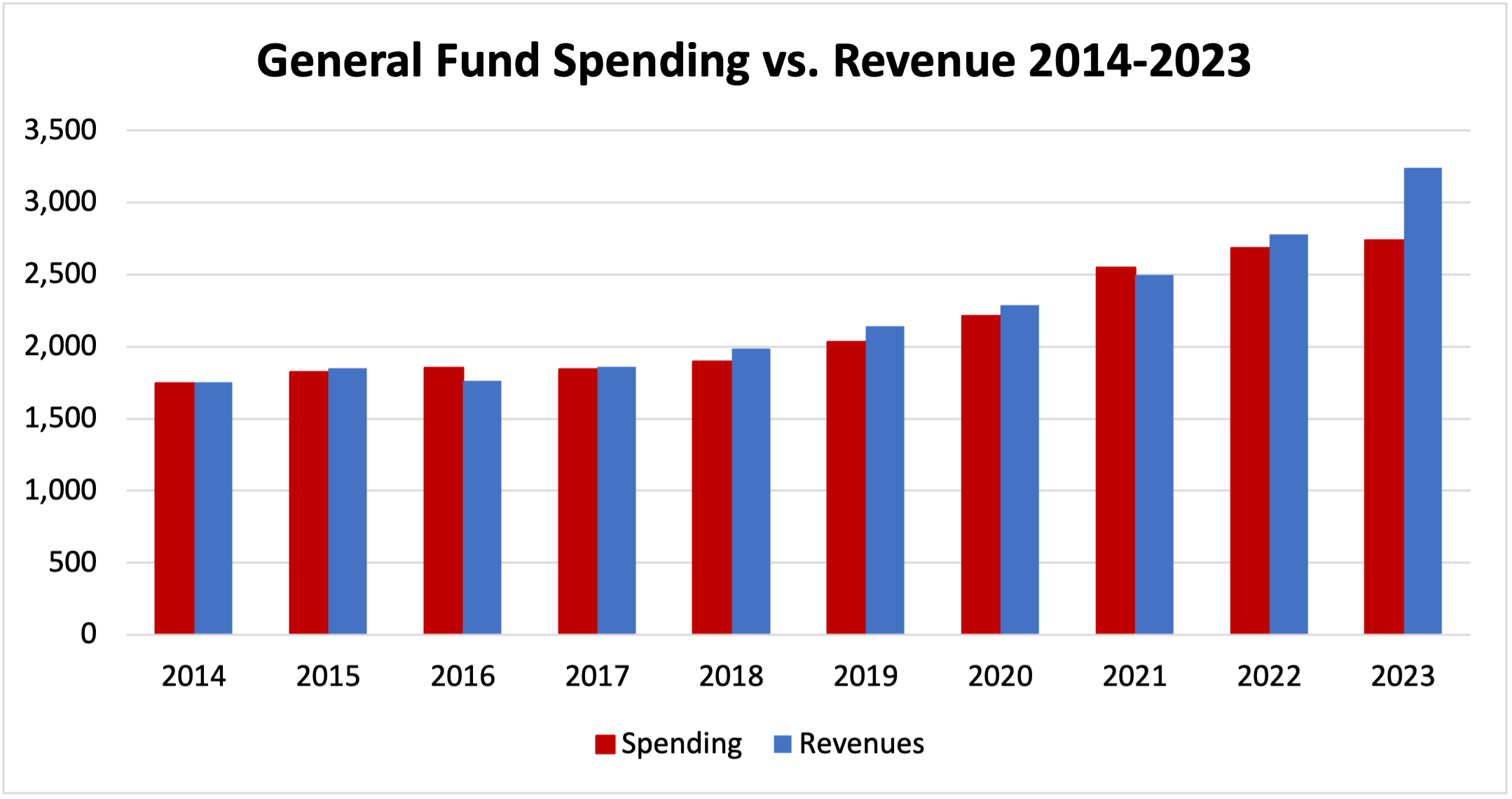

In fiscal year 2014 SGF funding totaled less than $1.75 billion. By 2023, total SGF spending had risen to above $2.7 billion annually, an increase of 56.7% Over the same period of time, SGF revenues rose by about 84.5%, reaching over $3.2 billion in 2023.

Over the past five years, SGF spending increased by 34.6% from the $1.9 billion appropriated in 2019. From fiscal year 2019 through 2023 revenues to the SGF grew by 51.4%, about $1.1 billion in new annual revenues compared to 2019.