The Truth About PRICE Act Funding and Costs

This week, House Bill 295 by Rep. Ernie Yarbrough, the Parental Rights in Children’s Education (PRICE) Act, is scheduled to receive a public hearing in the House Education Policy Committee. As introduced, the bill provides for the funding of education savings accounts (ESAs) for eligible participating public and non-public school K-12 students.

The Alabama Policy Institute (API) has long been a proponent of school choice. API believes that parents should have the freedom to use their state tax dollars to ensure that their children receive the highest quality of education available and that it meets the specific needs of the child, regardless of where they live and what their economic circumstances may be. It is also a concept that Alabamians overwhelmingly support. Recent polling from the Alabama Republican Party found that 78% of registered voters are in favor of expanded school choice options.

Under the provisions of the PRICE Act, the ESA program would be phased in over three years beginning in the 2024-2025 school year. That year, kindergarten, 3rd, 6th, 9th, and 12th grade students would be eligible. In 2025-2026, the same grades would be newly eligible, and in the 2026-2027 academic year all students would be eligible for the ESA program. Prior public school enrollment is not a requirement for eligibility.

HB 295 calls for initial ESA funding to be set at $6,900 per year, which represents the projected FY 2024 per pupil share of the Education Trust Fund’s Foundation Program appropriation. The subsequent years’ ESA funding allocation would be based on adjustments to the total per pupil share of the Foundation Program.

The most common refrain from opponents of the PRICE Act is that it will cost too much money and take resources away from currently operating public schools. However, money used to finance the ESA program represents tax dollars that have been collected from Alabamians. It is not costing the state money, rather it is empowering parents to determine how their tax dollars can best be used to educate their children.

Furthermore, API believes the notion that the state cannot afford to implement an ESA based school choice program is inaccurate. Over the past few years, the state has collected more taxes from Alabamians than at any point in the state’s more than 200 year history. Alabama’s state government has also spent more, specifically on education, than ever before.

Consider the following:

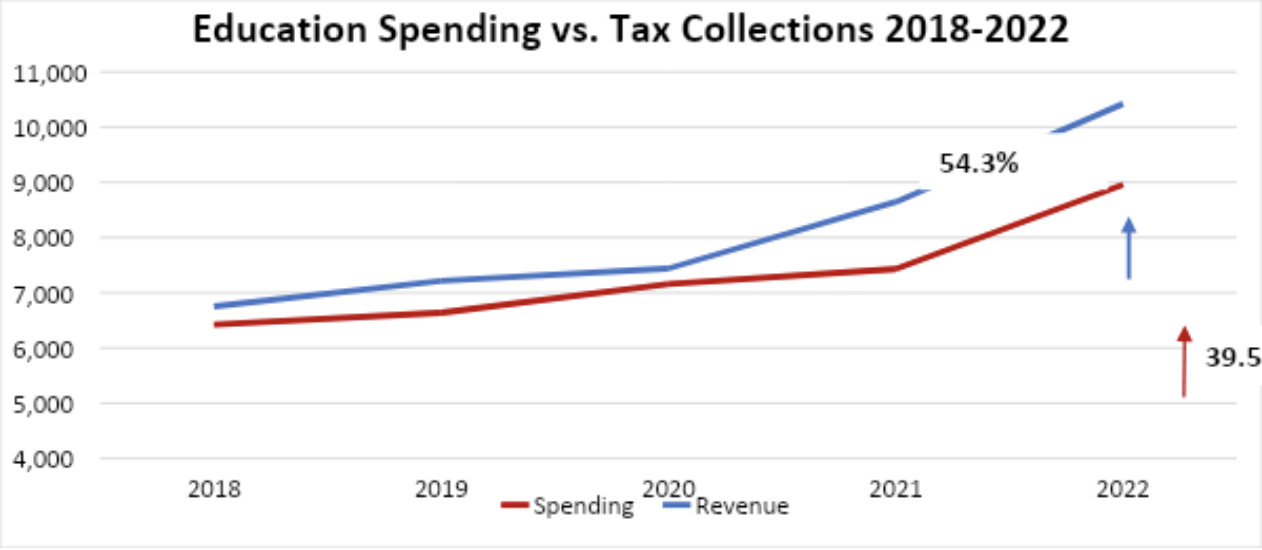

From 2018-2022 tax collections earmarked to the state’s Education Trust Fund grew by 54.3%, totaling more than $10.4 billion in 2022. That’s an additional $3.6 billion in new annual revenues over a five year period. Over the same five-year period, spending allocated by the Legislature for education purposes grew by 39.5%, reaching almost $9 billion (including supplemental appropriations) in FY 2022.

Alabama’s government entered FY2023 with more than $3 billion in total surplus revenue collections, money taken directly from taxpayers. Gov. Ivey has proposed spending nearly all that surplus this year, with at least $125 million of the revenues earmarked for education spending going towards clearly non-education purposes.

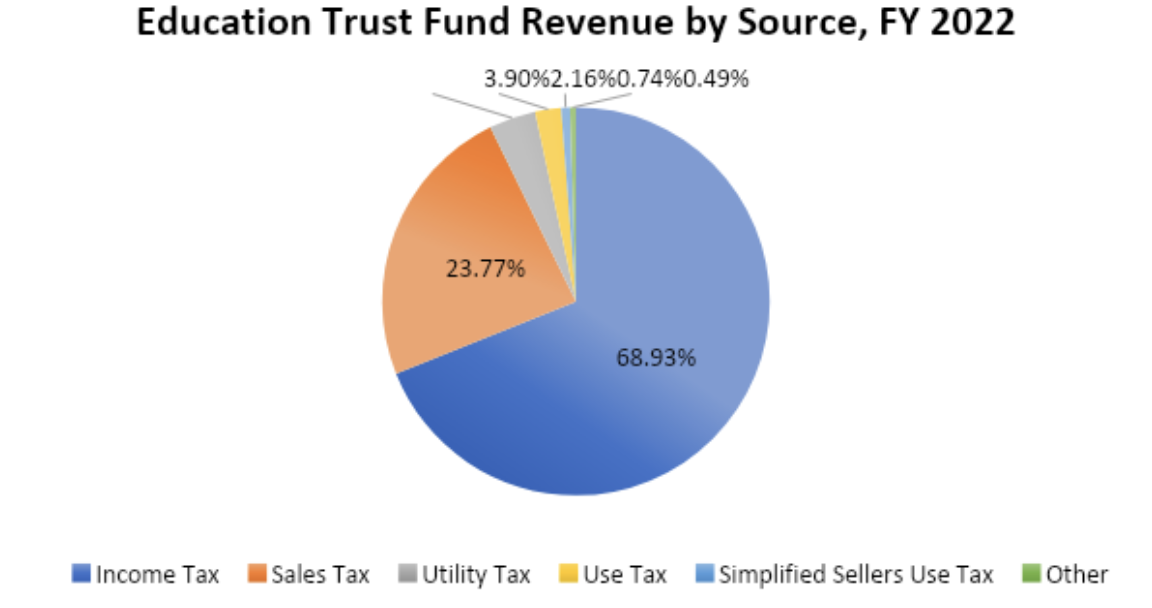

The primary funding mechanisms earmarked for education in Alabama are sales and income tax receipts. Over the past five years, sales tax, individual income tax, and corporate income tax receipts grew by 31.6%, 55.6%, and 210% respectively. Again, state government is taxing Alabamians more than ever before. Shouldn’t citizens have a say in how their tax dollars are being spent?

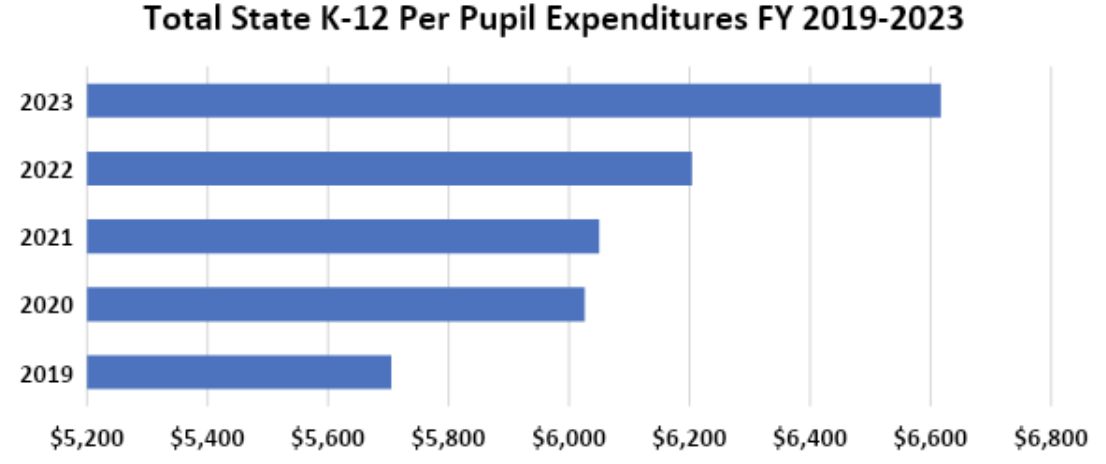

Aside from record education spending in general, K-12 spending, which comes primarily through an appropriation to the state’s Foundation Program, increased by 14.3% from 2019-2023. Per pupil K-12 spending grew by 15.5% over the past five years.

What have parents gotten from record spending? Alabama’s scores on the National Assessment of Educational Progress remain near or below where they were more than two decades ago. States such as Florida and Mississippi spend less money per pupil than Alabama and students achieve higher scores on national tests.

Another common refrain from school choice opponents is that the record revenue growth experienced by the state’s two operating budgets in recent years is not sustainable. While it is accurate that 54.3% ETF growth in five years is abnormal, the Alabama Legislative Services Agency (LSA) projects continued growth through the end of 2024 when total state revenues are estimated to reach almost $14 billion. It is not a matter of not being able to afford to provide an ESA program. However, lawmakers must carefully choose spending priorities and commit to slowing the growth of state government as a whole.

Questions also remain as to how much implementing a broad school choice program in Alabama will actually cost. According to the LSA’s fiscal note for Senate Bill 202 (the Senate version of the bill) the PRICE Act’s ESA program will cost the ETF a minimum of $288 million in the 2024-2025 school year and $576.1 million the following year. No estimate was provided for total costs in year three (full implementation), though presumably they would be higher than in year two.

The LSA estimate assumes that 5% of eligible public school students would leave their current school and attend a non-public school. Furthermore, the estimate assumes that all the state’s approximately 61,000 private school students would participate in the ESA program.

Based on real-world data from 31 states that have already enacted school choice legislation, LSA’s estimate of the cost of the PRICE Act is high.

According to data from EdChoice, a nonprofit, nonpartisan organization that advocates for educational freedom, the combined public and nonpublic ESA take-up rate in the first three years of other school choice programs are 0.29%, 0.82%, and 1.34% respectively, considerably lower than the 5% figure assumed in LSA’s fiscal note. A recent and relevant example of how many students might utilize the ESA program is Arizona, which launched its school choice program in 2022. In the first year of enrollment, public school students participated at a rate of 1.8% and nonpublic students had a take-up rate of 28.9%. There is no evidence of mass exodus from the public school system.

Another cost estimate of the PRICE Act, which was developed by the Reason Foundation and assumes the take-up rates calculated by EdChoice, estimates that once fully implemented the PRICE Act will have a net cost of $407.9 million per year. That’s 3.5% of all the money Alabama’s government spent in 2022. Reason Foundation’s estimate projects that approximately 2,880 public school students and 55,089 nonpublic school students will participate in the program by year three.

There is also empirical evidence that school choice programs save taxpayers money. According to a 2016 paper published by EdChoice, which identified 28 studies examining the fiscal impacts of school choice on taxpayers, in 25 cases the programs saved money and in the three other studies the programs were found to be revenue neutral.

Also of note is that despite paying taxes that finance education spending, Alabama’s 61,000 private school students have not utilized those resources, despite having a right to do so. Over the course of the past 20 years that equates to billions of dollars in savings to the state’s budgets.

Of equal if not more importance than the monetary impact is the fact that school choice programs have proven to improve academic outcomes for students. EdChoice has identified 18 studies examining school choice and changes in academic outcomes for students. 16 empirical studies found that school choice improved academic outcomes. Only two found that it negatively impacted students’ academic progress.

Alabama has spent decades spending more taxpayer dollars on education without achieving better academic outcomes for students. The state has the resources available to empower parents to choose the best learning environment for their child and fundamentally change the state’s educational framework.